I Feel Doom: Our Economy

BUMPED CLOSER TO THE TOP

(Warning! Long read ahead! All emphases by Always On Watch)

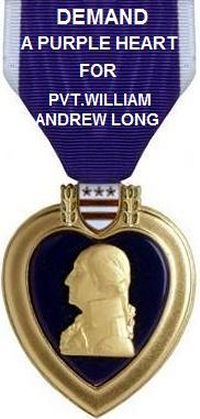

image source

The title for this posting comes from one of my students, who often utters those words when I announce a project or distribute a test. But I can think of no more appropriate words than "I feel doom" to sum up how I see the downward slide of our nation's economic health. My sinking feeling began last summer, when two banks told me that, due to defaults on mortgage payments and the paucity of those who deposit savings, both banks didn't have enough money to loan out. And now, in the past week alone, I've been seeing alarming stories about the devaluing of losses at Citigroup, Merrill Lynch, Morgan Stanley, Wachovia, and Capitol One. Sooner or later, our nation's economic problems, if I interpret them correctly, will touch you in a way you won't be able to ignore.

------------------

Yes, I've read the positive stories that our trade deficit has declined. And I've also read this hopeful November 7, 2007 "Recession's Hidden Virtues," a November 7, 2007 essay by Robert J. Samuelson. Excerpt:

...Recessions also have often-overlooked benefits. They dampen inflation. In weak markets, companies can't easily raise prices or workers' wages. Similarly, recessions punish reckless financial speculation and poor corporate investments. Bad bets don't pay off. These disciplining effects contribute to the economy's long-term strength, but it seems coldhearted to say so because the initial impact is hurtful.I'd like for Mr. Samuelson to be correct. But the fact is that the American dollar has significantly declined and seems poised to continue that drop. Excerpt from this November 9, 2007 article in the Washington Post:

Today, a U.S. recession might also reverse the upward spiral of oil prices and trigger a faster -- and healthier -- drop in home prices. As economist Berner notes, the slow decline in prices prolongs the housing slump, because it induces "would-be buyers [to] wait for more attractive deals." By making homes more affordable, a quick and sharp price drop might revive housing more rapidly....

The dollar sank to a new low against the euro on Friday but recovered some ground against the British pound even as Wall Street ended a turbulent week down sharply.So why aren't our politicians evincing concern? The following excerpt from this article in the November 8, 2007 edition of the Washington Post provides a clue:

[...]

The dollar weakened against many of the European currencies and the yen on Thursday after Federal Reserve Chairman Ben Bernanke said economic growth would slow noticeably in the United States in the coming months while rising oil costs would increase inflation pressures.

[...]

The dollar slid to an 18-month low against the yen, falling to 110.52 yen before rising slightly to 111.07 in late New York trading, below the 112.36 the Japanese currency was worth Thursday. The dollar also fell against the Swiss franc, falling to 1.1247 Swiss francs from 1.1268 Swiss francs Thursday, while rising to 94.15 Canadian cents Friday from 93.89 Canadian cents.

The Canadian dollar has risen almost 20 percent in value against the U.S. dollar this year, achieving one-to-one parity for the first time since 1976. On Wednesday, the Canadian dollar was worth $1.1039, its highest level in the post-1950 era of Canadian floating exchange rates.

...[P]rices of Canada's major exports, including oil and gold, have surged.

A cheaper dollar makes U.S. exporters more competitive on global markets. Economists are expecting a stronger export sector to help ease the pain from the sharp decline in the housing industry.At the same time, we are seeing a shift in global wealth, a shift not in favor of the United States:

High oil prices are fueling one of the biggest transfers of wealth in history. Oil consumers are paying $4 billion to $5 billion more for crude oil every day than they did just five years ago, pumping more than $2 trillion into the coffers of oil companies and oil-producing nations this year alone.Now comes this November 10, 2007 article in the Washington Post. Excerpt from "Campaign Advisers Focus on Mortgate Crisis: Presidential Candidates Differ Little within Parties":

[...]

In the United States, the rising bill for imported petroleum lowers already anemic consumer savings rates, adds to inflation, worsens the trade deficit, undermines the dollar and makes it more difficult for the Federal Reserve to balance its competing goals of fighting inflation and sustaining growth.

[...]

With crude oil prices nearing $100 a barrel, there is no end in sight to the redistribution of more than 1 percent of the world's gross domestic product. Earlier oil shocks generated giant shifts in wealth and pools of petrodollars, but they eventually faded and economies adjusted. This new high point in petroleum prices has arrived over four years, and many believe it will represent a new plateau even if prices drop back somewhat in coming months....

A new issue is emerging in the 2008 presidential race: how best to keep the mortgage crisis from driving millions of people from their homes.Helping home buyers to hold onto their home is a laudable goal, in my view. But at what cost to our economy as a whole, both nationally and globally, and to our national sovereignty? Excerpt from this November 9, 2007 article in WorldNetDaily:

Yesterday [November 9], economic advisers to five candidates debated mortgage and other issues, giving hints of how their bosses might deal with the issue. The three Democrats on the panel generally called for more aggressive government action to prevent the problems from spreading, while the two Republicans warned that too much intervention could create perverse rewards for financial institutions and individuals who made irresponsible decisions during the housing boom.

Crude oil prices hit an all-time high this week, closing above $98 a barrel for the first time in history.China holds substantial investment in US bonds. According to this April 2006 article in the BBC News,

According to the AAA, many drivers in my home state of California are already paying more than $4 a gallon for regular unleaded gas. And in one town south of Big Sur, unleaded gas topped $5 a gallon.

The U.S. dollar is at an all-time low, even when compared against the hapless Canadian loonie. Five years ago, a loonie was worth 60 cents. Today, it's worth $1.12 and climbing.

Yesterday, WorldNetDaily reported that the Chinese are considering abandoning the U.S. dollar as their national reserve currency. WND quoted Craig Smith's assessment of the consequences of such a move by Beijing on our economy: "If that were to happen, all bets are off, and we will be in a depression that makes 1929 look like child's play, or we will experience Weimar Republic inflation as the dollar makes extreme moves toward devaluations."...

China is a major funder of US debt, holding about $260bn (£149bn) in US Treasury bonds - second only to Japan.The figure is higher now: at least $1.43 trillion of foreign exchange reserves.

Any reduction in China's dollar assets could hit the US economy.

How serious is our national debt overall? According to one of the above-cited articles in WorldNetDaily:

On Tuesday [November 6], the U.S. national debt topped $9 trillion for the first time in history, according to the U.S. Treasury Department's daily accounting of the national debt. Nine trillion dollars! The number is so staggeringly high that it exceeds our ability to comprehend it in monetary units.A way to usher in the North American Union? Is that a reach? Maybe not. Read more at Stop the Security and Prosperity Partnership.

Million, billion, trillion – in financial terms, for most of us, it means a lot of money, really a lot of money, but that is about as specific a picture as most ordinary people can grasp.

Let's put all these "illions" into perspective. A million seconds is roughly 12 days, whereas a billion seconds is approximately 32 years.

We understand dollars. And we understand time. So it would take 12 days to pay back a million dollars at a dollar a second. But if you started right now, you'd pay back a BILLION dollars, at a dollar a second, in the year 2039.

A trillion seconds is roughly 32 thousand years. At a dollar a second, you'd pay back a TRILLION dollars in the year 34007.

The U.S. debt stands at $9 trillion. If my calculator is working, then at a dollar a second, the U.S. could be debt- free in the year 290007.

The point of that little exercise was two-fold. The first was to clarify the sheer volume of the debt; the second was to demonstrate the possibility that anybody in government really believes we can ever pay it off.

Each U.S. citizen's share of the national debt works out, according to the National Debt clock, to $29,947.50. That means the average American family of five owes, collectively, $149,737.50.

It also means that unless the average American family of five has a net worth of at least $149,737,50 in assets excluding liabilities (they don't), America is already bankrupt.

Over the past few years, there has been growing public concern about the emerging "Security and Prosperity Partnership" plan that some say is really a "deceptive roadmap" to a coming North American Union and a new, unified currency tentatively called the "amero."

The feds steadfastly deny such a plan exists, even as it opens the borders to Mexican truck traffic, widens the I-35 corridor from Mexico to Canada and, counterintuitively, refuses to tighten the borders with either Mexico or Canada, despite both logic and widespread public demand.

All of these things have brought me to believe that powerful forces outside of our government – like the shadowy international Money Trust members of the "Bilderberg Group" – made a decision to force the formation of the North American Union along with the amero. There decisions have been instituted in the past via the Trilateral Commission, which is the dba for the nefarious Conference on Foreign Relations. Destroying the American dollar could force the crisis that would force the creation of the North American Union. To quote the title of a book of the 1960s era, "None Dare Call It Conspiracy."

Ordinary Americans may not fully grasp just how dire the true economic picture is, but you can bet our leaders do. Yet from the White House to the Federal Reserve, nobody seems particularly eager to address the issue, preferring instead to talk about the "budget," as if the budget WERE the debt, rather than merely a measure of our ability to keep up with our payments on the debt.

It is almost as if they already have a Plan B in reserve, ready and waiting to be triumphantly introduced – just in the nick of time.

Labels: our ailing economy

<< Home